Fundraising | We often get asked

How to build a series A compatible cap table?

Building a venture backed startup is hard and most of the financial rewards are realised at an exit 7+ years from the founding date. Equity is the long-term tool that gets everyone aligned on value creation and the cap table is how distribution of equity is presented to the investors in a fundraising.

Common mistakes founders make

A common mistake is not having co-founders. A single founder is rarely investable for venture capitalists. Typical venture backed start-ups have 2-4 founders with diverse sets of skills and one or two founders with larger shareholdings than others.

A capitalization table is a summary of the current capitalization (i.e. equity ownership) in a startup or venture-backed business.

Cap tables are important as they show how much the co-founders value each other’s skills and what they think their impact is on realising the big vision.

Founders should talk not only about their roles and decision making, but also about what they see as good and bad leavers, and what happens to shareholdings in these situations.

Vesting and a cliff are common tools in option programs to protect the cap table and align the interests of employees and shareholders. Why not use these for founders when founding companies too?

At founding and in most early stages only operational founders should have shares.

Sometimes there is a board chair or an investor or a corporation whose idea was spun into a startup. This partner takes no part in operations but has a large hold of the shares. This mistake is very difficult to correct later.

Spin-offs and companies by investor/passive founders are rarely investable by venture investors.

Looking at a Pre-Seed to Series A cap table – what should happen in the different stages?

Raising the Pre-Seed

This is one of the most difficult rounds to raise for founders. It’s very difficult to decide what percentage to sell and how much money to raise. The company has no real value. The investment must be worth the risk of losing it all.

Our recommendation is to sell 10-15% and raise enough to build a team that gets the minimum viable product (MVP) launched and sold to a handful of customers that act as validation.

The valuation should be set so that the investors can earn 2-3x on paper in the next round in less than 18 months from your pre-seed.

Bringing in the Seed investors

You’ve got your product out and a great initial team. You are raising to hire, develop your product further and to invest in the go-to-market.

All of this did not happen without making promises to new hires of equity participation.

It is common that your first option pool was created before the seed round, however, now it is required by the Seed investors. A typical option pool is 10% and it’s commonly topped up at each round.

Typical terms are 4-year vesting and a first-year cliff for options grants.

Today the most competitive pre-seed startups have an option to raise a large or a smaller Seed round. The bigger rounds might dilute you 30%+ and the smaller 20%.

For most startups the goal is to raise an 18-month runway from 1-2 investors that are of great quality and likely to bridge you 3-9 months to a Series A if needed.

Founders and team must own well over 50% for the startup to remain fundable in the future.

Series A

You’ve successfully executed your international go-to-market model and built a product-market-fit. The numbers show 2-3x revenue growth and a burn multiple from recent quarters that is below 2x. It’s time for the Series A fundraise.

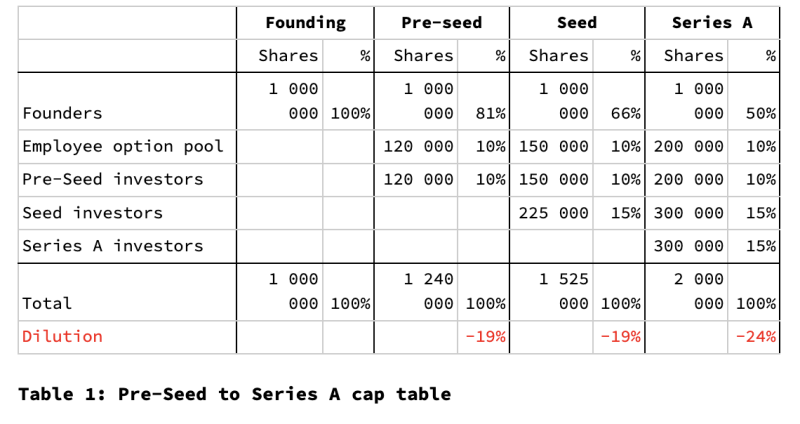

After this fundraise it’s typical that the founders and team own less than the investors. We’ve put together a sample cap table evolution for you to see what the likely evolution presented in this article is.

You should expect all investors to hold on to their ownership (pro-rata) at each round if you are successful and they have funds left.

Typically, investors aim at 10-20% ownership and the dilution for each round is 20-30% with the option pool top-ups.

Who answered the question?

FURTHER READING

How to prepare for an effective board meeting?

Building a venture backed startup is hard and most of the financial rewards are realised at an exit 7+ years...

Juuso Klemola, myPlane: Place value in your personal connections

Building a venture backed startup is hard and most of the financial rewards are realised at an exit 7+ years...